Five Steps to Getting Your Finances in Order

You are prepared for business school academically and professionally, now it’s time to prepare financially.

Step 1: Get your finances in order

- Save money to pay for at least a part of the cost of your education

- Reduce your credit card debt

- Pay down your car loan

- Prepare a budget

Step 2: Understand the financial aid process

Before you can get a loan, the school has to approve your application for financial aid. Only then can a lender loan you money. To improve your chances of getting the loan, reduce personal debt as much as possible and stay up to date on credit card payments and outstanding loans.

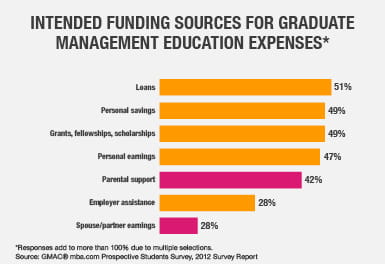

To get an idea of how you might fund your education, see how your peers are paying for theirs:

Step 3: Review your business school costs

Total costs of attending business school include:

- Tuition and fees

- Academic expenses including technology, books, and supplies

- Cost of living (the cost of maintaining your standard of living, which varies depending on location)

- Opportunity costs (compare your projected earnings over the next several years with and without a graduate business degree)

Step 4: Get your credit report and credit score

Get your credit history and credit score from appropriate credit bureaus in your region, and review each report carefully. If any information on these reports seems inconsistent or incorrect, you can file a dispute on the credit bureau’s website. Additionally, close lines of credit (such as credit cards) that you no longer use, but don't close all your accounts at once, open new lines of credit, or take out new loans, or your credit score could be lowered.

Step 5: Start reducing expenses

Pare down expenses wherever you can. You might be surprised at how small changes in your spending habits will help out in the long run.

Did you know? A school may not allow you to borrow the maximum a lender will approve. Schools use an estimated cost of education and living expenses to figure out what you should borrow, which may be less than the maximum you could borrow.